Property taxes, like all taxes, are mired in controversy. We hear from hundreds of owners every year, and the refrain is often the same: “They’re too high”; “We don’t want to pay them”; “They don’t make sense”; “The services that I receive from the Municipality are declining, but my taxes keep going up”…

But still, we need to pay for our municipal services. Halifax, for example, has historically relied on property taxes to fund approximately 80% of its budget. Part of the controversy (and discontent!) with taxes stems from misunderstandings of how the property taxation system works. This blog post will focus on a few of the central tenets of Nova Scotia’s property taxation system. This primer will (hopefully) help you as a property owner/manager confront your issues with assessments and property taxes in the right place, and with the right people.

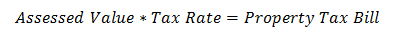

The first issue that needs to be clarified is the taxation process itself. Your tax bill is the product of two numbers: an assessed value and the tax rate (or mill rate).

Lesson 1: Assessed values are the responsibility of the PVSC.

Assessed values are the responsibility of the Property Valuation Services Corporation, a not-for-profit corporation at arm’s-length from the government. The PVSC’s has a CEO and a board of directors: these directors are in turn made up of representatives from individual municipalities. We are experts in valuation, and as a consequence, our Property Tax Division specialises in – you guessed it – assessed values! Any issue with your assessed value is a matter to be taken up with the PVSC.

Assessment in Nova Scotia is done on an ad valorem basis (Latin for “according to value”) meaning property is assessed at its estimated market value. The PVSC completes a revaluation of all the properties in Nova Scotia on an annual basis: some 612,000 properties. The valuation of all the properties is compiled into what is called the assessment roll. This roll is then forwarded to the Municipality, who use it to formulate tax rates.

Lesson 2: Tax rates (and tax bills!) are the responsibility of the municipality.

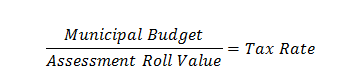

Now, to move onto the next item in the equation: tax rates. Tax rates are set by municipalities. They are determined by setting a budget, calculating the total value of the assessment roll, and dividing those two numbers:

Now, there is a lot of fine print in this equation (especially regarding commercial versus residential tax rates), but what’s important to recognise is that the PVSC assesses the properties’ values, municipalities determine the tax rates (and what those taxes pay for). Once the city has set its tax rate, they send out a tax bill to all property owners, and then in turn provide services to the community. Your elected municipal representatives determine the services to provide and how they will be financed, this in turn creates a budget and voila! a tax rate is born.

Lesson 3: Property taxes are based on the market value of property, not benefits received or services provided (or anything else!).

Another important takeaway from all of this is that ad valorem taxes are a tax on wealth. They are not a tax on income, and they are not a tax on services rendered. The idea behind the ad valorem tax is that wealth is a proxy for ability to pay: those with a greater ability to pay should pay more. Unlike income tax, property tax is not a tax on earnings: it is a tax on wealth. This is especially important for income producing properties, as income and property value are two very different things. Now that we’ve determined how a tax bill is calculated, let’s look at when: the ‘base date’ of valuation for assessment is January 1st, two years prior to the current assessment year. For instance: the current assessment year is 2015. The ‘base date’ or ‘effective date of valuation’ is January 1st, 2013. But what does this really mean in practice? It means that PVSC, who are estimating market value, are trying to determine the market value two years ago.

Why is this ‘base date’ issue important or even relevant at all? Because, as property owners, you feel market conditions as they happen. If you have an apartment building and just can’t keep the units occupied, your vacancy and subsequent cash flow are hurting now. What this two year ‘base date’ lag creates is disconnect between when vacancies happen and when you (may) feel some kind of assessment relief. This isn’t to say that your current struggles can’t be considered, but for the most part, what’s happening to you now is going to show up in your assessment (and subsequently your tax bill) in two years.

This blog post is intended as a primer to help you as property manager/owner/operator understand the basic process behind your tax bill. Property assessment and taxation are complex issues with a lot going on behind the scenes (and I mean a lot). Turner Drake specialises in the assessment half of the equation: municipalities set tax rates, and there’s nothing we can do about that. What we can do, however, is ensure that your assessment is fair. My boss has told me time and time again: “we all have to pay our taxes, but that doesn’t mean you have to leave a tip.”

Property assessment and taxation lessons provided by Greg Kerry, Manager of our Property Tax Division and Toronto Operations. If you have any questions about your property tax assessment, feel free to contact Greg at , (902) 429-1811 (Halifax) or 1 (800) 567-3033.