Our Economic Intelligence Unit is always on the hunt for new data sources to bolster our maps and feed our spreadsheets: any good analysis begins with high quality data. The majority of our databases are populated with a wealth of information via a process of blood, sweat, and tears (though increasingly data is graciously released by provincial gatekeepers) and it could be that our next trove of valuable data is being cultivated on farms across the Maritimes. The movement of food from field to plate involves numerous stops along the agricultural supply chain and, when property tracked, that data can prove valuable for a host of analytical tasks.

The ability to track an item from Point A to B in a large-scale supply chain is known as traceability. The theory behind it is relevant in all aspects of our lives: be it an Amazon package or a donair pizza, consumers – and businesses – have discovered that real-time knowledge of where a product is, physically, at any point in time is a competitive advantage in terms of marketing and efficiency. Agriculture is no exception. Traceability is already in use as a health risk management tool: it allows for rapid response to health emergencies by identifying exactly where and when afflicted produce or livestock stopped along the supply chain. Efficiently pin-pointing sources of contamination (think E.coli outbreaks) and creating cost-effective responses, such as targeted treatments and recalls, are critical in a modern, globally connected agricultural sector.

In addition to the obvious benefits of using traceability from an epidemiology perspective, there is also major potential for economic spinoff benefits from tracking the movement of agricultural goods. At a recent gathering of Nova Scotian Agrologists, speaker Chris deWaal of Getaway Farm (of Seaport Market fame) touted the very real benefits of offering consumers the entire life history of their food as a competitive advantage over mass-produced “mystery meat.” The introduction of the “Trace My Catch” program for canned seafood provides an example of how seafood processors are embracing traceability as a marketing tool, and provides an indication of the feasibility of doing so. In a province with a growing love affair for all things local it is no surprise that demand for local meat and produce is on the rise.

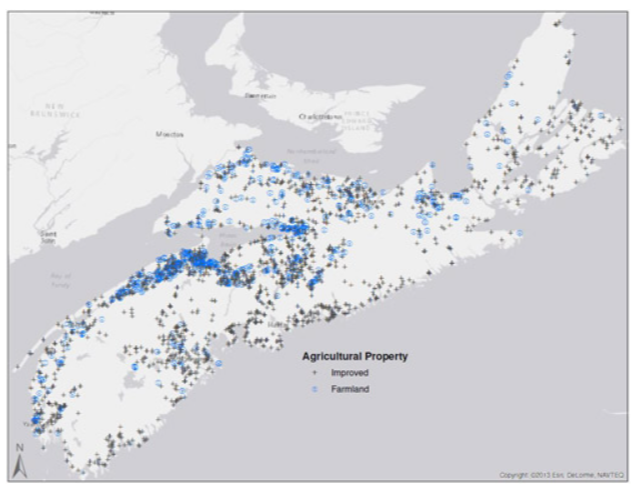

Benefits beyond health and marketing can be opened with traced agricultural data. Used in conjunction with GIS, the location and density of animals, farms, stockyards, abattoirs, and processing facilities become inputs for site selection and trade area analysis and indicators of economic health in rural economies – an issue of pressing concern for many Nova Scotian communities.

Imagine opening a meat processing and distribution facility to feed growing demand for local, organic products while still maintaining capacity for foreign exports. A standard GIS-based site selection analysis would use static location data (suppliers, purchasers) with network data (highway, rail, sea) to build a short-list of potential development sites which minimize transportation costs for both inputs and outputs. Additional variables such as workforce availability, machinery and equipment suppliers, veterinary services, and property taxes can all be integrated with locational data to suit the needs of the processor. But a standard analysis does not take into account how many animals are produced by individual farms or the variability in production from year to year.

Traceability data can enhance GIS analysis by optimizing site selection so it is based on not just the density of farms within a trade area, but the capacity to bring high volumes of livestock (or produce) efficiently to market. Historic tracking data of individual animals could forecast future production including where livestock are ultimately processed and sold. A savvy processor would use this data to identify opportunities for expansion and generate reliable, defendable business projections.

The agricultural sector already collects traceability data for use in health risk management; leveraging that same wealth of data for marketing and day-to-day business operations is the logical next step. The agricultural sector is a ray of light in the gloom of rural Nova Scotia: according to Statistics Canada’s census, between 2006 and 2011, Nova Scotia was the only province in Canada to see an increase in the number of farms, total farm area, and number of farm operators. Should the 2016 census indicate continued growth, it will clearly indicate that it’s time for all players in the agricultural game to leverage their existing data infrastructure to gain a competitive advantage at home and abroad.

For more information on how spatial analysis can benefit your business, call James Stephens at 902-429-1811 ext. 346 or visit: Economic Intelligence Unit