If you own a residential property in Nova Scotia you may have noticed recently when you received your assessment notice that there are two values assigned to your assessment; the market value and the capped value. If you’ve lived in your home for a few years now, you will have also noticed that your capped value is lower than your market value. You might be thinking that you are benefiting from the capped value, but in reality for a lot of people those savings are what we call “phantom savings”. The Capped Assessment Program (CAP) was introduced in 1995 in order to protect homeowners from rapid and sudden increases in assessment values. The CAP was implemented in response to concerns from families and seniors worried about not being able to afford higher property tax bills as a result of higher assessment values. It sounds like a great idea, but there are some major flaws in the program.

One the biggest issues with the CAP is that it doesn’t discriminate between homeowners with high levels of wealth or lower levels of income. The property owner who hasn’t seen much of a rise in the market value of his or her property will end up having to pay higher tax rates in the long run in order to subsidise the properties which have increased significantly in value but are only paying taxes on a much lower capped value. The problem will only get worse over time.

The longer the program remains in place, the more distorted the assessment base becomes. Assisting those who can least afford to pay their property taxes would be better served with more targeted efforts such as credits and deferral programs. Allowing seniors to defer a portion of their property taxes when their assessment values increase will allow them to stay in their homes longer and once their homes are sold the outstanding taxes can then be repaid. Some people believe that it’s important to continue using the capping program because taxpayers benefit from lower property taxes. This is a gross misconception however. Every year municipalities need to collect a certain amount of revenue in order to fund their budgets. Property tax collection is the main source of revenue for municipalities and whether everyone has a high assessment value or a low assessment value, the tax rate needs to be adjusted accordingly in order to generate the necessary amount of revenue. If we lower one of the factors, the other must go up and vice versa.

Property Taxes = Assessed Value (or Capped Value) x Municipal Tax Rate

The result is that for many properties, a reduction in the assessed value via the cap simply results in a higher tax rate and a shift in the tax burden to properties which are ineligible for the cap. The CAP is not producing the outcomes that it was designed to do, and I’ll provide a simplified example to illustrate one of the problems with the program.

In our example, the municipality consists of many different neighbourhoods with all different types of properties, but we’re going to narrow our focus and make the assumption that there are only two types of houses that will fall under the CAP criteria and all other properties are assessed at their market value. The two types of capped homes are each in a different neighbourhood; we’ll call them Home A and Home B. The people that live in the neighbourhood with home type A are mostly seniors and families that have lived in the area for a long time. These are older homes that haven’t been renovated in years. The people that live in the neighbourhood with home type B are younger working age people who all built brand new homes in a new up-and-coming neighbourhood back in 2007. As of 2007, both home types had a market value of $200,000.

The people that live in Home A have seen the market value of their property rise at an annual rate of 3% which is slightly above the capped rate while the people that live in Home B have seen an annual increase of 8% in the market value of their property which is much higher than the capped rate of growth. While homeowners in both house may be thinking that they are benefitting from the CAP, in reality the people living in House A (i.e. seniors) are having to pay property taxes at a higher tax rate in order to subsidise the lower capped values of the working age people in House B.

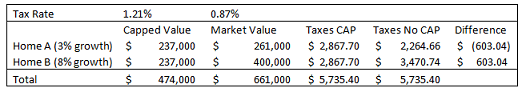

The table below shows that the taxable value of both house types is $237,000 and produces tax revenues of $2,867.70 per house on a rate of 1.21%. If we were to remove the CAP, the tax rate could actually be lowered to 0.87% and the people living in Home A would actually pay less property taxes while people in Home B would pay more.

While there are people out there who are benefitting from the CAP, the program has serious flaws and is creating distortions in the assessment base. For more information on the CAP, I encourage you to check out the Final Report on Municipal Property Taxation by the Union of Nova Scotia Municipalities which can be found on their website.

Written by Mathieu Chaput, Consultant in our Property Tax Division. If you have any questions about your property tax assessment, feel free to contact Mathieu at (902) 429-1811 or