When you think of the ideal office space, what are your must-haves? An environmentally friendly building? Open work spaces? Proximity to your home or city amenities? These are considered some of the most commonly desired traits in office space by HRM tenants. Office space that fit this bill is becoming more available in the downtown core. Does this mean that the recent trend of moving into office space in the suburbs will come to an end?

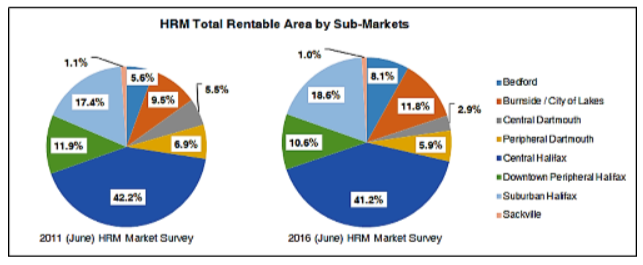

HRM comprises eight urban and suburban sub-markets: Central Halifax, Central Dartmouth, Downtown Peripheral Halifax, Suburban Halifax, Peripheral Dartmouth, Burnside/City of Lakes, Bedford and Sackville. Notable changes to these submarkets since 2011 include 950,000ft.2 of new office space added to the rental market in Central Halifax, Bedford, Burnside/City of Lakes and Suburban Halifax.

With the current lagging economy, it is not surprising to learn that vacancy has almost doubled in the last five years, especially considering the plethora of new office space brought on stream throughout HRM. Vacancy increased in every submarket, but the changes in vacancy rates indicate a shift in where demand for office space is flowing – to suburban business parks. For example, Burnside/City of Lakes and Suburban Halifax experienced among the lowest increases in vacancy. The chart below reflects how the distribution of total rentable area by sub-market has changed in the last five years.

It’s not all bad news for the CBD, though… vacancy in downtown Halifax saw a below average increase in vacancy. This begs the question: because suburban space was highly available, are tenants moving there because they wanted to, or because of its availability? With more space coming on stream in the downtown core consistent with commonly desirable office traits, does this mean tenants will start to shift back toward the downtown core?

In the last year, vacancy increased in the downtown core, not because of tenants vacating the area, but because there is more inventory available. Urban space is competing against new, modern office developments in suburban business parks (previously the only option for new office space in the city) and the population is concentrating in the urban core. With rental rates stagnating as vacancy rises, this is the prime opportunity for tenants to move into new space… and perhaps that space will be in the downtown area.