Who’s Going to Live In All Those Houses? – A common refrain when there’s a lot of residential development, whether houses, apartments, or condos. Demographic trends can help to answer the question after the fact, but more importantly, attention to demographic patterns ahead of developing can ensure that housing supply meets demand. After all, once it’s built, housing supply is here for the long haul. At the recent NSPDA and LPPANS conference, Turner Drake led a workshop examining how individual decisions feed into patterns in housing supply and demand. Here’s a brief recap (granted, a Nova Scotia‑oriented recap, but many of the principles apply across Atlantic Canada).

The Life Cycle of Housing

A typical person will move around a bit in their lives, starting out in their parents’ house (or houses: if we can infer Canadian behaviours from American stats, the average person owns 4.5 to 5.5 houses in their lifetime), moving to a rental apartment before buying their own home(s). Later in life, they may downsize back to an apartment (possibly a more luxurious one this time) or condo, and finally make their way to a seniors’ residence.

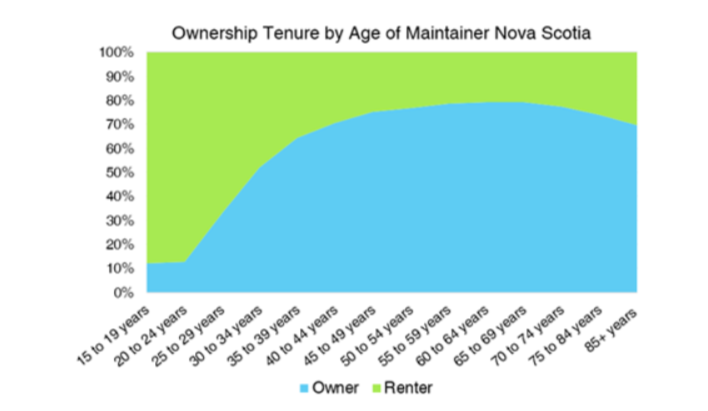

In-demand housing stock is heavily dependent on the dominant age groups in any given area. The primary drivers of rental apartment demand are 20-29 year-olds, and the 65-and-older cohort, though the latter is increasingly shifting to a 75-year-plus bracket, and the former arguably extends to above age 35.

The inverse is demand for owned housing, and the primary buyers are ages 25 through 45. The 25-29/34 year-old age bracket falls into each of the renter and buyer categories: this is the first-time homebuyer age range, where we see the steepest increase in home-ownership rates. The inference is that by age 45, buyers have bought their first home, possibly sold it and upsized to a larger family home, and here they stay for a prolonged period of time.

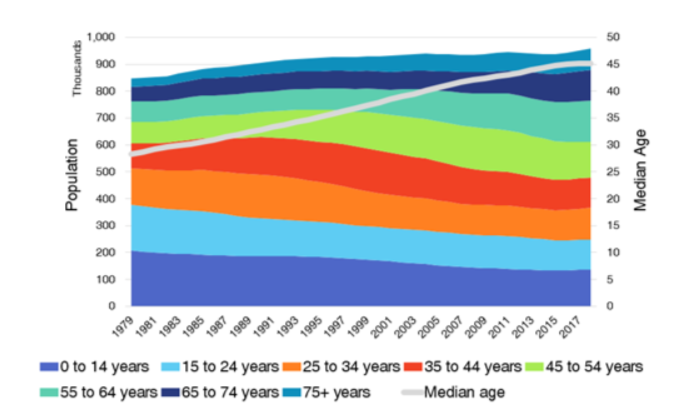

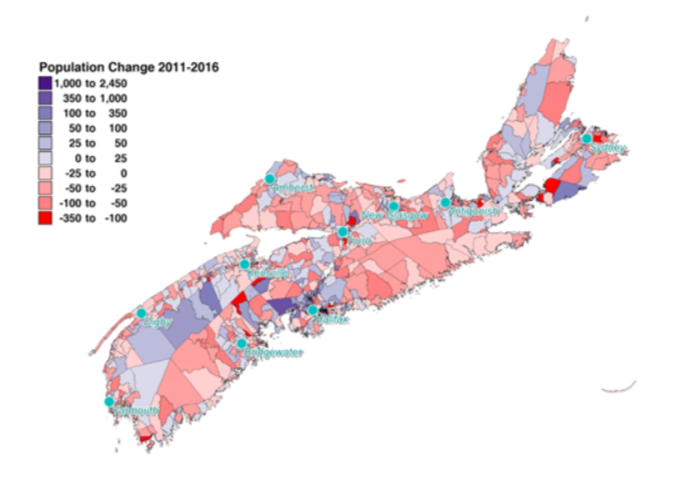

The graph above shows shrinkage in the brackets that include ages 20 through 45, but growth in the 65+ brackets. Growth in the 55-64 year old bracket means that the latter will continue to expand as Baby Boomers age. A 2018 Royal LePage survey of home buying intentions found that 42% of Atlantic Canadian Baby Boomers plan to downsize in retirement, with 23% intending to sell their homes and move to their secondary properties, i.e. to the cottage. Thirty-two percent would consider buying a cottage in which to live in retirement. The answer is probably no, but all this moving to the cottage raises the question of whether the province will see population ruralisation over the next few censuses, or whether the urbanisation of younger generations will continue in numbers sufficient to offset it? The map below shows population change at the Dissemination Area level in Nova Scotia between the last two censuses: the concentration of purple (growth) in urban areas, in contrast with the pink and red (shrinkage) of the rural areas, indicates urbanisation.

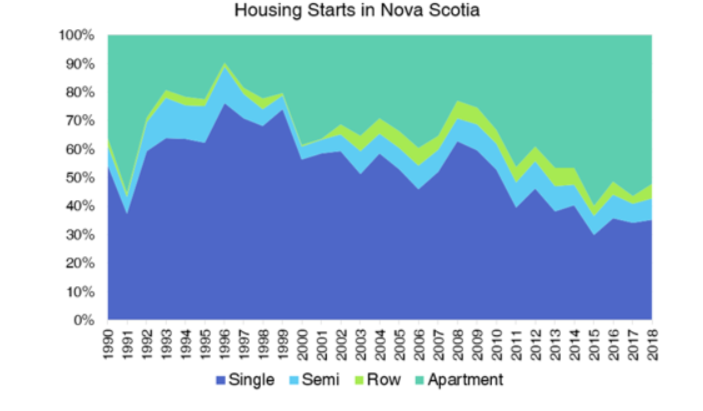

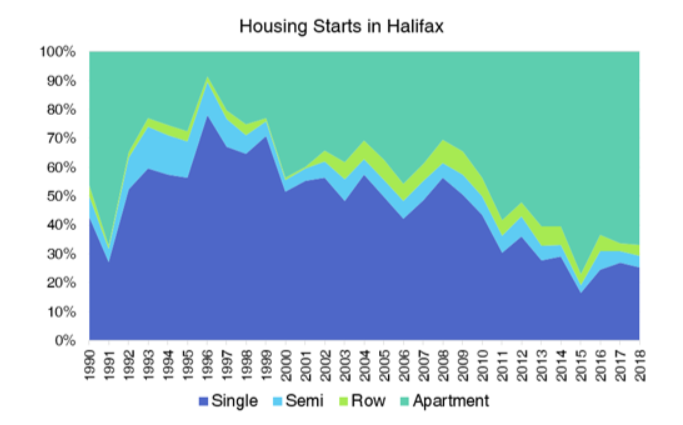

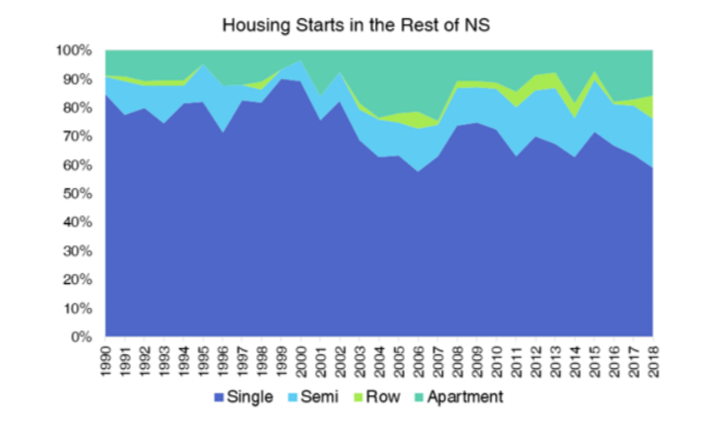

Just 29% of Atlantic Canadian Baby Boomers would consider purchasing a condo, the lowest rate in the county. Recall that the stat comes from a survey of home buying intentions…and recent trends have been for downsizers to opt for rental apartments over condominium apartments. There is certainly incoming supply of apartment units: CMHC statistics on housing starts over the past few decades show a distinct shift from single-family construction to apartments:

…at least in Halifax:

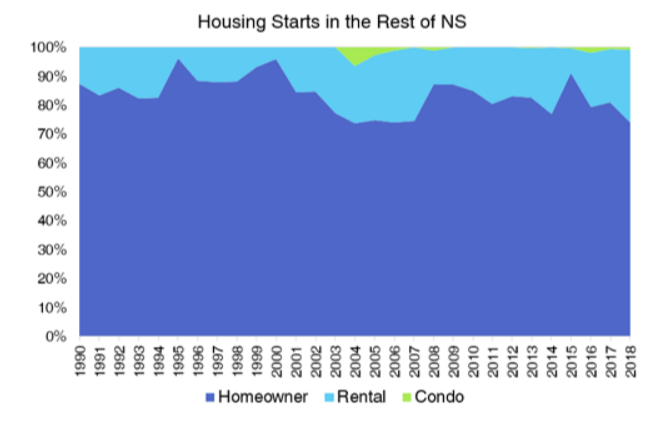

…though the rest of Nova Scotia is a different story:

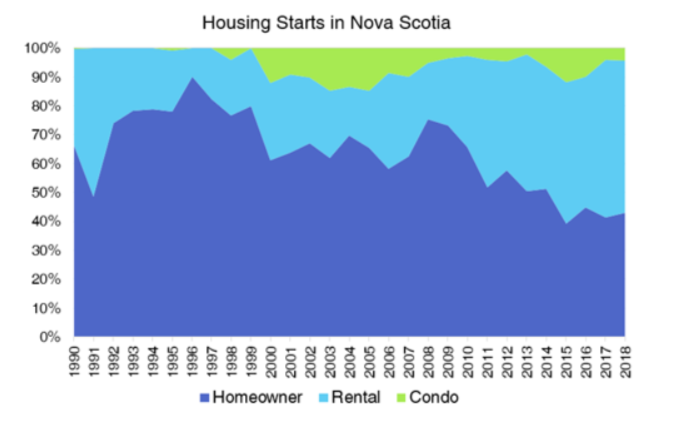

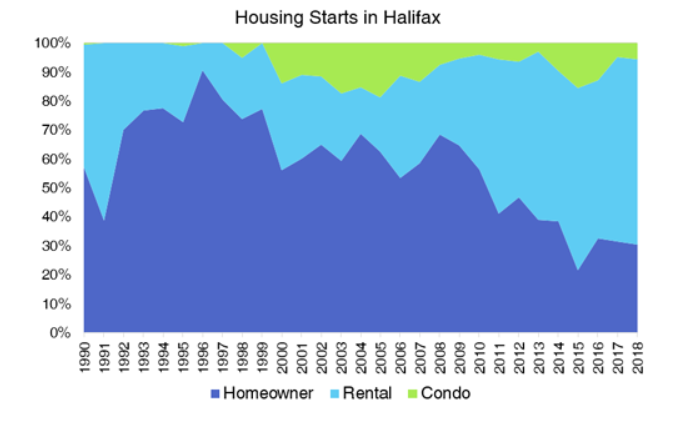

The breakdown of the same housing start data shows a distinct rental intention:

…which again is driven almost entirely by the Halifax pattern:

…while the rest of the province still shows a clear preference for offering options for home ownership, with very little constructed for either the rental or the condominium market:

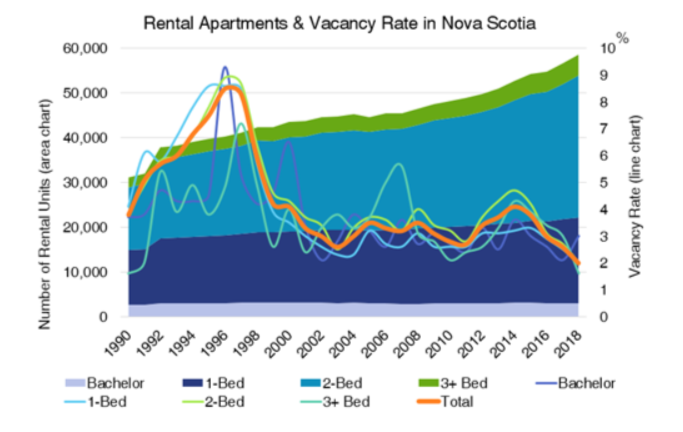

On the demand side, the province appears largely influenced by the statistics for Halifax, with vacancy mirroring the same ups and downs over the past three decades, though vacancy is a bit tighter in the city (overall 2% in NS and 1.6% in Halifax in October 2018). Demand is strong: vacancy rates have been falling since 2014, even as the inventory of rental units has been steadily increasing.

In the years ahead, expect continued growth in demand for higher density residential forms, especially of the rental variety. This trend is driven by the Halifax market, and offers an appealing lifestyle (low maintenance, low commitment), combined with the option to live off the equity unlocked from the sale of the family home. It is not far-fetched to extrapolate that demand for multi-unit rental apartments may also exist in smaller municipalities in the province, but that rural housing economics (lower housing prices but similar construction costs) have thus far constrained the supply side of the equation.

Turner Drake & Partners’ Economic Intelligence Unit follows closely trends in real estate and the factors that can impact its value, from demographic patterns and preferences, to climate change. Custom reports translate data into conclusions. For more information on how we can assist you, please call or email Alexandra Baird Allen: 902-429-1811 x323 or .