It goes without saying that the COVID-19 pandemic has directly and abruptly affected both short-term cash flow and long-term economic prospects for real estate owners in the Atlantic region. Commercial and investment property has been particularly hard-hit, with hospitality and retail property profoundly (and in many cases, irreversibly) impacted.

Not surprisingly, my colleagues and I field multiple inquires a week respecting the potential for property tax relief. Unfortunately, we find ourselves delivering the unwelcome news that there’s very little immediate aid available; in some cases, not for years to come. A little background will help to explain why this is so.

Property taxes are the product of a property’s assessed value (a point in time estimate of market value which is calculated as of a legislated date: in assessment parlance, the “base date”), and the applicable tax rate. In most Atlantic Canadian jurisdictions, assessment and taxation are separate functions. Assessed values are calculated by assessing authorities (the Property Valuation Services Corporation in NS; Service New Brunswick in NB; the Department of Finance in PEI; the Municipal Assessment Agency and the City of St. John’s in NL); mil rates are set (and taxes collected) by the municipalities.

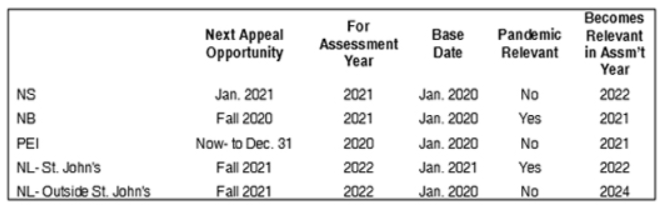

In providing relief, Atlantic Canada’s assessing authorities and its municipalities are stymied by legislative authority that varies from jurisdiction to jurisdiction. The ability for the pandemic to be reflected in assessed values (which, in all four provinces, are to market value) depends to large degree on the base date:

On the taxation side, we have prepared a reference guide detailing the myriad of programs available in various Atlantic Canadian cities, towns and municipalities[1]. It is available on our websites at https://www.turnerdrake.net and https://www.turnerdrake.com/services/property-tax-consulting/. The vast majority have been limited to extension of tax deadlines and reductions in interest rates applied to arrears.

There is little that can be done with respect to the tax rate applied to your property[1]; your tax management strategy should therefore focus on your assessed value. What will be the impact of the pandemic on values? In my opinion, few property types will escape unscathed, and for many, recovery will be protracted. While I don’t have a crystal ball, we do have a rear view: experience in the aftermath of historic cataclysmic events- e.g. the recessions of the early 1990s and 2007-2009; 911; and SARS, for example- will all provide guidance in establishing the penalties on the value of ICI real estate.

Property taxes can be an enigma under conventional circumstances. COVID-19 has created a property tax quagmire. My colleagues and I would be happy to provide advice on a property-specific basis.

[1] The exception are Nova Scotia’s roofed accommodations, restaurants, and campgrounds. Under a pre-existing provision in the Assessment Act, any property closed, or anticipating being closed, for four months of the municipal taxation year may apply for a Seasonal Tourist Business Designation. Eligible properties will see their tax rate reduced by 25%. Applications must be filed by September 1st.

Giselle Kakamousias is the Vice-President of Turner Drake’s Property Tax Division. Her experience negotiating and appealing property assessments is extensive: it is a wise property owner who follows her advice. If you’d like more of it, she can be reached at (902) 429-1811 ext. 333 or .