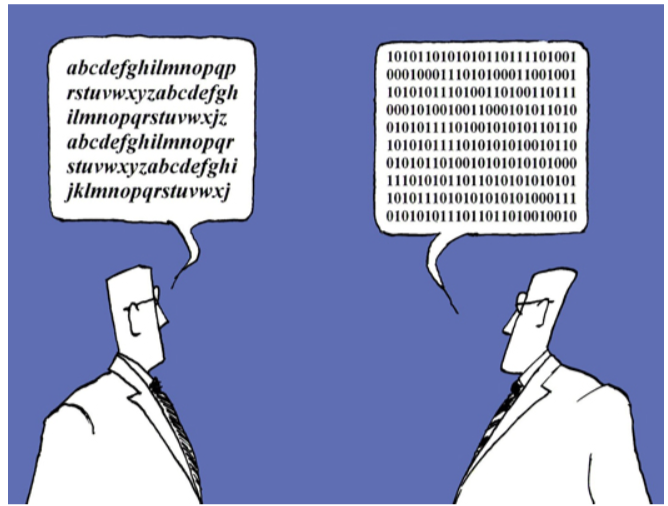

The Asking Price is a critical element when listing a commercial property. If it is too low you may under sell your property. If it is too high it will scare away prospective purchasers and the listing will go stale: it may then be necessary to withdraw the property from the market and re-introduce it at a later date, or alternatively reduce the price substantially to reignite interest. But while property sells at Market Value, owners often measure its worth in terms of Intrinsic Value. This can give rise to a difficult conversation between real estate broker and property owner.

Market Value is generally defined as “the most probable price which a property should bring in a competitive and open market as of the specified date under all conditions requisite to a fair sale, the buyer and seller each acting prudently and knowledgeably, and assuming the price is not affected by undue stimulus”. More specifically, market value is based upon a property’s Highest and Best Use. The Highest and Best Use of a property is the probable and legal use of land, or an improved property, that is physically possible (what can be physically built on the site?), legally permissible (what uses are permitted under the current zoning?), financially feasible (will the purchaser achieve an acceptable return within a reasonable investment horizon?) and maximally productive (what use generates the highest return?). Simply put Market Value is the highest price attainable assuming the property is expertly marketed to the widest pool of prospective, knowledgeable purchasers.

Intrinsic value is the owner’s perception of the inherent value of their property to them. This value can be based on the actual amount of money they have invested in the asset, any sweat equity by the owner, emotional attachment, or just their perception of current market conditions. Sometimes the property owner may be constrained by the debt burdening the property, or the net cash they need to realise on sale after paying capital gains tax and transaction costs.

How do you bridge the divide between Market and Intrinsic Values? It starts with the acceptance by both parties, broker and property owner, that they have a common goal… to sell the property on the most advantageous terms to the owner. Before we undertake to market a property for sale, we sit down with the owner (vendor) to go over the marketing plan for their property, the pricing strategy, and the listing agreement, to ensure the vendor understands the selling process and each party’s obligations under the contractual arrangement. Since an appropriate asking price is critical, we research the property, its zoning and planning considerations, and sale prices of comparable properties, to develop an asking price based on the Market Value. Because Intrinsic Value frequently differs from Market Value the vendor may have price expectations that cannot be realised on sale and it may be better to withhold the property from the market until prices increase…. realising of course that there is always the risk that prices may fall too, as is the case currently in some market sectors. However if the owner is serious about selling, it is imperative that the asking price be reflective of Market Value plus a negotiating buffer (every purchaser likes to feel like they have negotiated a good deal for themselves). Otherwise, the overpriced property will sit on the market and become stigmatised: potential purchasers will wonder why it has been on the market for longer than is typical, if there is something wrong with the property, or will want to try to use the long marketing exposure as negotiating leverage. On the other hand if a property is reasonably priced and is properly exposed to the market, a vendor will have much better chance of consummating a sale at a price, and within a time frame, that optimises their sales transaction.

Reduce Stress: Live Longer

Selling your property, even commercial real estate, is rarely anybody’s idea of fun… so we have compiled a list of the difficult questions you meant to ask your real estate broker but were too embarrassed, simply forgot… or did not know you should ask. Questions such as “I don’t want my staff to know I am selling: what can I do to keep it quiet?” or “I am already talking to a prospective purchaser: do I still have to pay you a commission if I sell to them?” and even “Why do I need a real estate broker anyway?”. Better still we have provided our answers in the way we do best… frank, forthright and brutally honest! Call or email me, I will happily send them to you.

As Senior Manager of our Brokerage Division, Ashley Urquhart assists both landlords and tenants meet their space requirements, and vendors and purchasers optimise their property portfolios. For more real estate brokerage advice, you can reach her at or (902) 429-1811.