Boy howdy, let me tell you how tempting it is today to write another blog post about housing, what with a new majority provincial government, and the shameful campaign of homelessness evictions launched by HRM. It’s a topic we will be sure to revisit soon, but the honest truth is a while ago I started writing this piece about a different issue in pressing need of attention, and there just is not the time to pivot.

That other issue, of course, is the long emergency of climate change. A long emergency that is rapidly becoming shorter according to the recently released 6th Assessment Report of the Intergovernmental Panel on Climate Change. The outlook is grim, with some irreversible effects of climate change now baked into our future, and an ever-diminishing window of opportunity to take action and head off the worst. This is ‘code red for humanity’ as put by UN Secretary General, Antonio Guterres.

A few months ago, I turned 35. Old man, I know. But even from here, just past the threshold of maturity, let me tell you that aging is a hell of a trip. With a few decades and milestones under my belt, I can now regularly perceive the arc of time, but still hold clearly in my mind the memories of early childhood when nothing existed beyond the “now”. I can vividly remember, for example, sitting in the school library in Grade 4 and learning about the Montreal Protocol and how it reversed the depletion of the ozone layer (something very topical to a pasty redhead with British genes). I remember learning how something called the Kyoto Protocol was going to help prevent a different environmental crisis called Global Warming. It felt like an imperceptible eon away at the time, what a different world we would be facing if that had panned out.

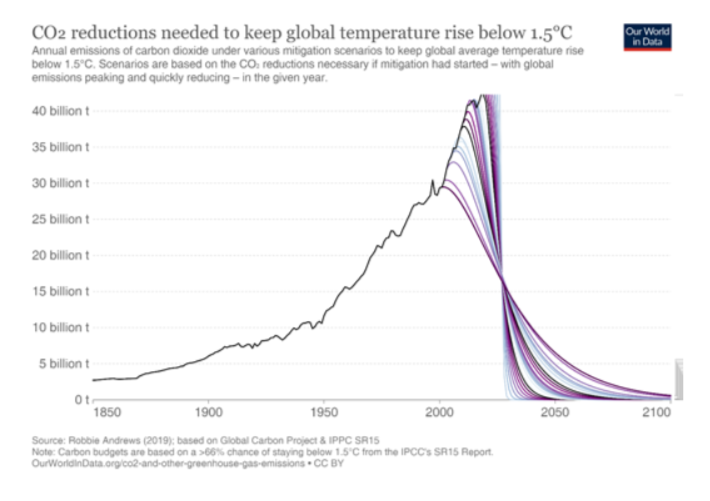

My daughter turned 5 this spring and at the moment her “now” is a lot more focused on Covid than climate, but that will probably change soon. That long arc of time leading to climate-driven environmental and social crises has converged with the now. As the IPCC report lays out, our window of opportunity to shape future impacts and head off the worst is running out. Not in imperceptible eons, not in generations, but in a decade (singular), in near-term political cycles. In all likeliness, I will know whether or not my daughter is inheriting a disastrous +2°C world before I know whether or not she’s passed her driver’s test.

But even that sentiment downplays the issue. In fact, we are already living with the impacts of climate change and it’s easy to find the real estate angle. Earlier this week our social media accounts shared this article from the CBC examining the lack of climate risk information in the typical real estate transaction process. The topic is presented against the background of raging wildfires in the BC interior, which have destroyed numerous homes and disrupted even more communities. This is already leading to some early musings that the housing markets of Vancouver Island could see a groundswell of demand pressure over the long term as people are increasingly motivated to move upwind of areas where “50-year fires” are now happening multiple times in a decade, threatening life and shelter, and choking out the rest.

So far, the smoke is dissipating before it reaches this side of the continent, so our concerns are not so focused on forest fires (though, not to be ignored). Sea level rise and flooding are the risks du jour. We’ve visited this topic a number of times already, in research articles from 2006, 2007, 2013, 2016, and most recently 2019. It’s a subject that we care about and have integrated into our valuation practice, adding a climate risk section to our standard reports just a few years ago. But as one small firm in this big industry it is difficult for us to push that envelope.

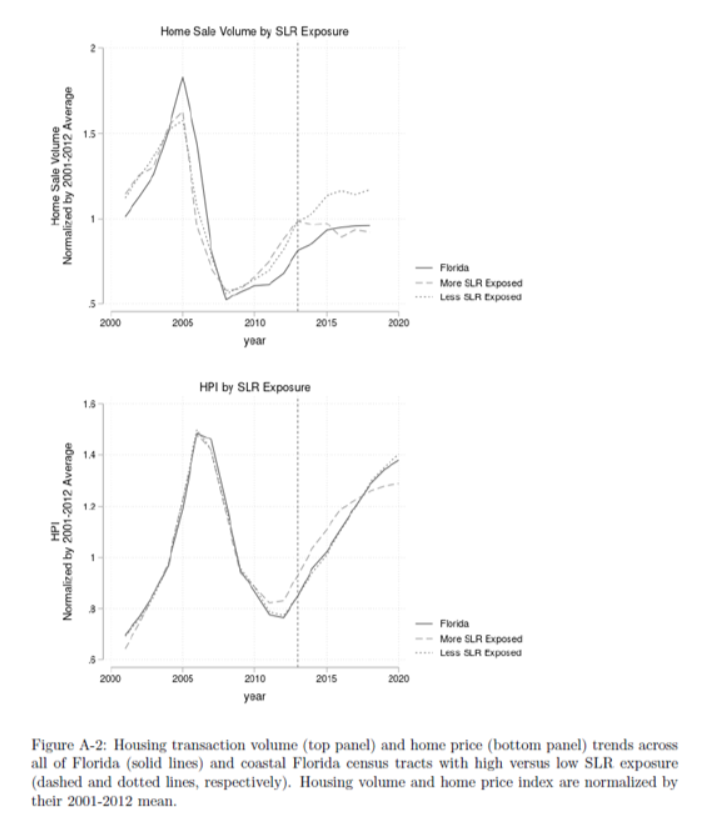

Well, reality is on its way to force the issue. Back in the fall of last year the National Bureau of Economic Research published a working paper from a couple good eggs at the Wharton School examining the capitalization of climate risk in real estate prices. More specifically, their analysis of home sales in coastal areas of Florida noted that properties more exposed to the risks of Sea Level Rise started to see lagging sales volumes in the early 2010s, with price appreciation starting its underperformance a few years later. Their conclusion is this is a demand-side trend, buyers are now thinking about climate change in the timespan of their own mortgage term! Here’s the money chart:

This trend is just starting, and with the IPCC telling us that a +1.5°C world is now unavoidable, it will only grow in impact in the years to come. Not eons, not generations, years. We’ll continue to look for ways to integrate climate risk assessment into our work, and we recommend that anyone considering a real estate acquisition these days do the same. Even if you don’t expect to own the property long enough for sea level rise and other climate impacts to physically threaten your asset, the next buyer sure could be, and property values look to be a leading indicator now, not a trailing one. In other words, without due care, your mortgage could be underwater long before the property itself is.

Neil Lovitt is the Vice President of Turner Drake’s Planning and Economic Intelligence divisions. He engages in numerous consulting assignments, including non-market housing feasibility studies, Housing Needs Assessments from coast to coast, land inventory analyses, and infrastructure studies. To see how you can benefit from the unique expertise of our Planning and Economic Intelligence team, call Neil at (902) 429-1811 or .