Recently, you may have come across some news coverage of a project we’ve started; from now until early 2023 we will be working on a Housing Needs Assessment for the entirety of Nova Scotia. It’s a bit unusual for us to be fielding media requests about the beginning of a project, usually the interest comes at the end when we actually have some results to talk about… if the interest comes at all. Yet, we shouldn’t be too surprised. Housing challenges continue to grow across Canada, and in many ways Nova Scotia has been particularly impacted. This is an issue we’ve been engaged in for some years now, building up our experience from Truro, NS to Terrace, BC. We are very excited at the opportunity this project creates for us to set a new standard for conducting these types of analyses, all right here in our home province.

I would be remiss to not prominently mention the collaborating firms we have on our team. While Turner Drake is getting the name recognition due to our role as project manager, the reality is this is very much a combined effort. In fact, the budget for this project is more directed to public engagement than data analysis – my excel file doesn’t care if I load in data for 1 municipality or 49, but talking to people can’t scale like that. We have an enormous geography to cover, and a diversity of stakeholders in each community to engage with. So, we are thrilled to have Upland Planning & Design Studio as well as Colab undertaking that process with us. Back closer to our focus, we are excited to be collaborating with MountainMath on the analytics and data dissemination.

Beyond the team itself, the scope of work we have gives us even more to look forward to. The RFP issued by the Province for this study was thorough enough to ensure the right questions will be answered, but was also flexible enough that we were able to put our own spin on things to ultimately propose a Needs Assessment as we think they should be done. We can’t get into everything, but here are a few highlights:

- We are excited to finally undertake this work with the benefit of data from the 2021 Census as it is released over the course of this year. While data sets related to the housing market and inventory are updated at least annually, this is not the case for many important socio-economic indicators that tell us about the people who are trying to access and maintain that housing. The 2021 Census will give us a contemporary view into these factors, something that has been an increasing challenge with this work over the last number of years. Until this point, we’ve had to rely on the 2016 Census, which predates virtually every important trend affecting our housing situation today.

- We are also eager to introduce a much more detailed understanding of Short Term Rental activity (i.e. AirBNB) across the province. This is a fraught topic; the use of our housing stock for short-term rental purposes has very clear negative and positive impacts, and these are highly variable between communities, and even across different neighbourhoods in the same community. Up to this point a lack of detailed data has prevented us from clearly understanding where the problems are, and how severe they may be. We’re looking forward to pulling back the curtain on this facet of the housing market!

- Finally, this project is an opportunity for us to up the ante in terms of making our work useful and accessible. While government is our client, housing issues are top of mind for many across the province and we want our efforts to benefit anyone working toward housing solutions. It is incredibly difficult to write a static report that presents such a breadth of information (both thematic and geographic) in a way that is useful to more than a few end users. That is why we are exploring how to better share our results so more people across the province can adapt it to their needs, interests, and locations. A more dynamic, web-based, and customizable approach to disseminating housing-related data and insights is one of the outcomes I am most excited for.

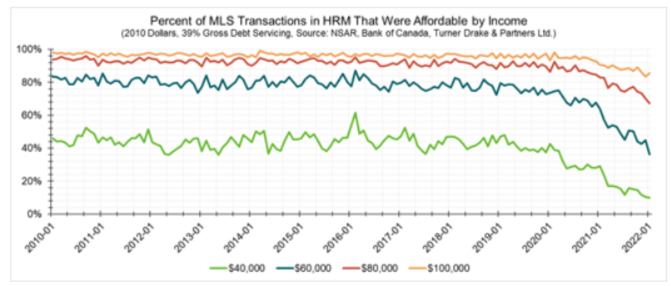

While this project will provide our client with key information they need to design and target public policy responses, the unfortunate reality is that our work will take time, and across the board we are playing a game of catchup where time is the most precious commodity. Housing affordability has rapidly eroded over the course of the pandemic, and was being degraded more slowly for years before that. Take a look at trends just in the owner-occupied market (which has lagged the rental market in terms of demand pressure):

This is only a narrow view of a larger and more complex picture, but it helps to illustrate just how severe the problem is for lower income households. Not long ago, a household earning $40,000 had a shot at about half of the ownership opportunities across HRM, these days they’re fighting it out for the cheapest 10% of the market. While across Canada we are starting to see more serious engagement in the issue and more on-the-ground interventions, my perspective is that no jurisdiction is yet grappling with the elephant in the room; that a sizable proportion of the population is now firmly outside the boundaries of what market-rate housing can serve. None of the low hanging fruit or amount of “innovative” policy and partnership that is comfortably within the boundaries of government intervention is going to get around this basic fact, and it’s going to take time for government to tool up and get back to engaging with this issue at a scale that approaches historic precedents.

Neil Lovitt is the Vice President of Turner Drake’s Planning and Economic Intelligence divisions. He engages in numerous consulting assignments, including non-market housing feasibility studies, Housing Needs Assessments from coast to coast, land inventory analyses, and infrastructure studies. To see how you can benefit from the unique expertise of our Planning and Economic Intelligence team, call Neil at (902) 429-1811 or .