Hello everyone! My name is Jigme Choerab and I am the new Manager of the Economic Intelligence Unit at Turner Drake & Partners. I am originally from Bhutan, but became a proud Canadian permanent resident in 2023. I came to Halifax in September 2019, and the pandemic hit six months later. When the pandemic was in full flight, I remember a conversation I had with a couple of colleagues discussing the implications it could have on the Canadian economy in a couple of years. We thought that there might be a baby-boom in 2021; we discussed the possibility of a sustained period of deflation; and we also spoke about a “U-shaped” recovery in Canada. We could have never expected supply chain disruptions in the magnitude that transpired, nor could we have imagined that there would be as much pent-up demand as there proved to be. I guess like they say, “economists predict nine of the next five recessions.” However, another thing we discussed and were right about was the major role interest rates would play in the recovery. So, when I was told that I could write about anything in these blogs, I had to take the chance to discuss how interest rates have shaped the country and our province, Nova Scotia, since 2020.

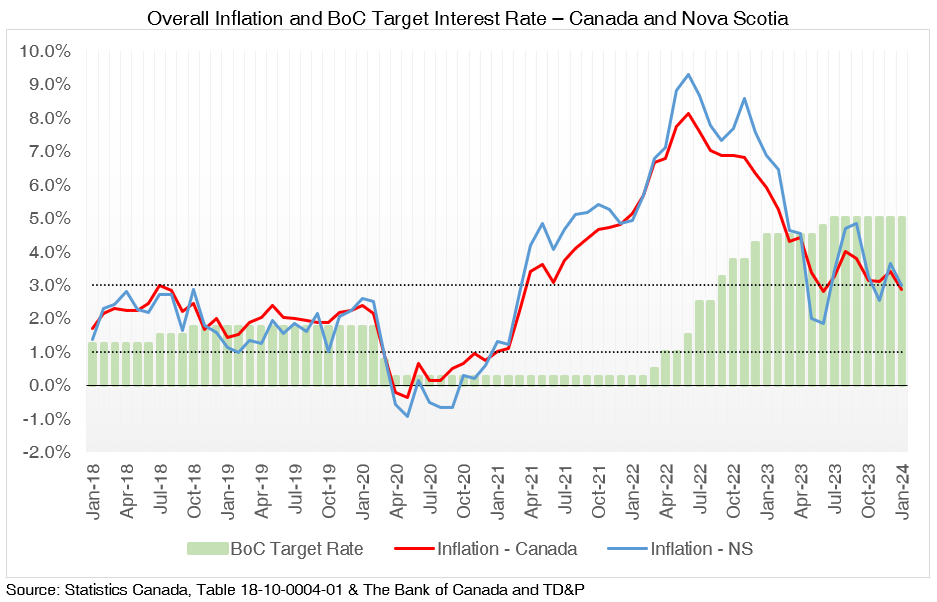

After the topic on Gross Domestic Product (GDP) and its components, the next major topic that every student studies in their first macroeconomics class is the relationship between the interest rate and inflation. In a gist, during times of economic contractions (or a perception of one, at least), a lower interest rate encourages borrowing and investment activity, driving economic growth. On the other hand, if the economy is growing too fast, a higher interest rate would make borrowing more expensive thereby slowing economic activity back to the desired level. Under this topic the student learns that it is usually the role of the Central Bank of a country, the Bank of Canada (BoC) in our country’s case, to set a target interest rate as part of its broader monetary policy. The BoC’s main goal is to keep inflation in check (their target is to keep it between 1% to 3%), and the question these days is if they’ve managed that, and what their next move should be in 2024.

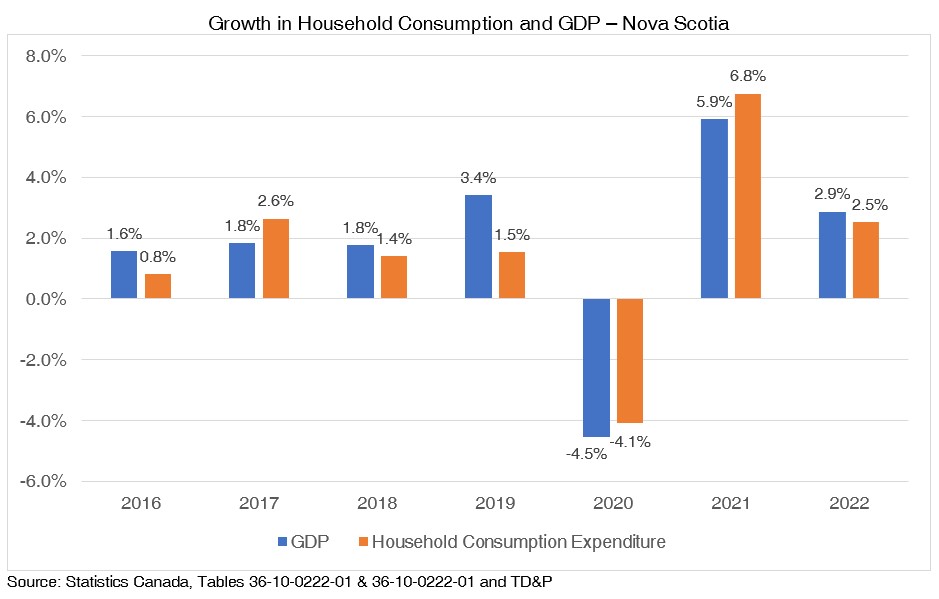

When the pandemic hit in early 2020, to say that global economic activity slowed would be an understatement. Unemployment was higher than ever, especially in the service sector, and everyone was afraid of what would happen next. I remember in the middle of 2020 when year-over-year price growth was negative, and everyone feared a prolonged period of deflation stemming from low demand in the economy. When prices first started to drop, the BoC jumped in lowering the interest rate from 1.75% in February 2020, to 0.75% the next month, and to 0.25% the month after. They maintained it at 0.25% for two years. At the same time, the Federal government implemented direct and indirect income assistance programs, low interest loans, debt deferral programs, rent caps, and many more with the idea to put money in peoples’ pockets so they’d keep spending and driving the economy forward. The result was a growth in household consumption in every province of the country bar Saskatchewan. In fact, in 2021, Nova Scotia saw the largest increase in household consumption expenditure in record at 6.8%. The economy was strong because people were spending, the borders were open again so population growth saw record highs, and it seemed like the mix of low interest rates and income assistance programs had done the trick. But then 2022 came along.

In June of 2022, overall inflation in Canada was 8.1%, while it was even higher in Nova Scotia at 9.3%. The province’s inflation grew 5.2 percentage points in a single year. Across the country, prices had grown at a level not seen since the 1980s. So, what happened? Well, simply put, there was excess demand in the economy, while supply chains were being disrupted. Firstly, we had a lot of pent-up demand. When the economy reopened, we started spending on things we couldn’t while in lockdown. Additionally, the new residents welcomed to Canada brought with them their own demand. This higher demand, especially in service sectors, drove up prices. Simultaneously, Russia invaded Ukraine, and Canadians felt the pinch at gas stations and at grocery stores for food items.

Consequently, the BoC started raising interest rates to curb inflation. Between March 2022 and March 2023, their target interest rate jumped from 0.50% to 4.50%, and as of January 2024, at 5.00%. Just yesterday, the BoC announced that they’d be holding rates again, saying that ‘more time’ would be needed for higher interest rates to have an effect. What does that mean? Well, higher interest rates have undoubtedly helped lower inflation, but have price levels necessary fallen across the board?

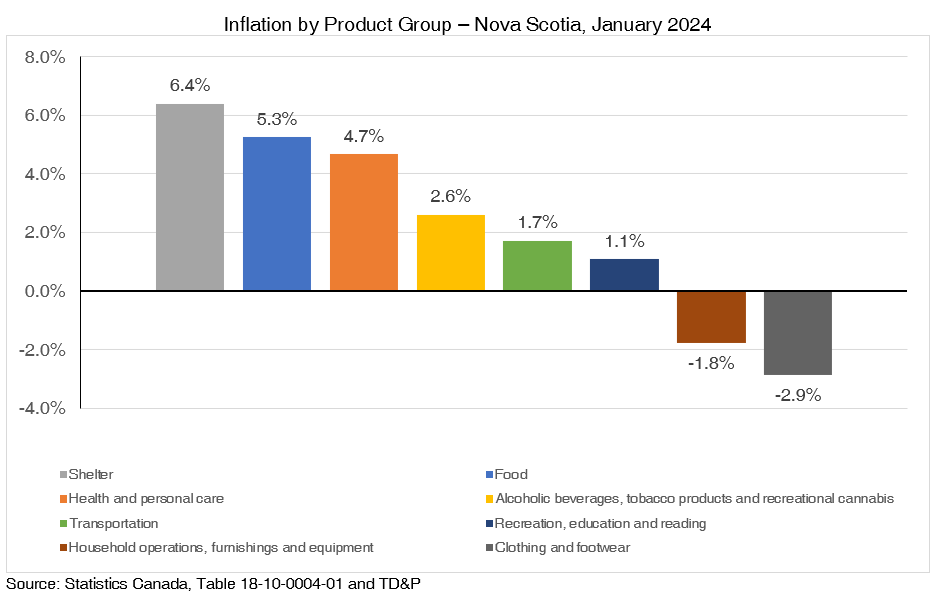

The inflation rate in Nova Scotia stood at 3.0% and the Canadian rate was 2.9% in January 2024, which basically falls within the BoC’s target range of 1% to 3%. Unsurprisingly, there have been a lot of people predicting and calling for the BoC to lower interest rates later this year now that inflation seems to be under control. However, when we examine the components within the overall figure it provides a better perspective.

In January, shelter costs were up 6.4% since a year ago, followed by food prices that saw an increase of 5.3% year-over-year. Third up was health and personal care costs that saw an annual increase of 4.7%. So, apparently, the product groups for which prices are growing more than we’d like them to are the ones that are basic necessities. Now, for the purpose of brevity, let’s only explore these shelter costs a little further.

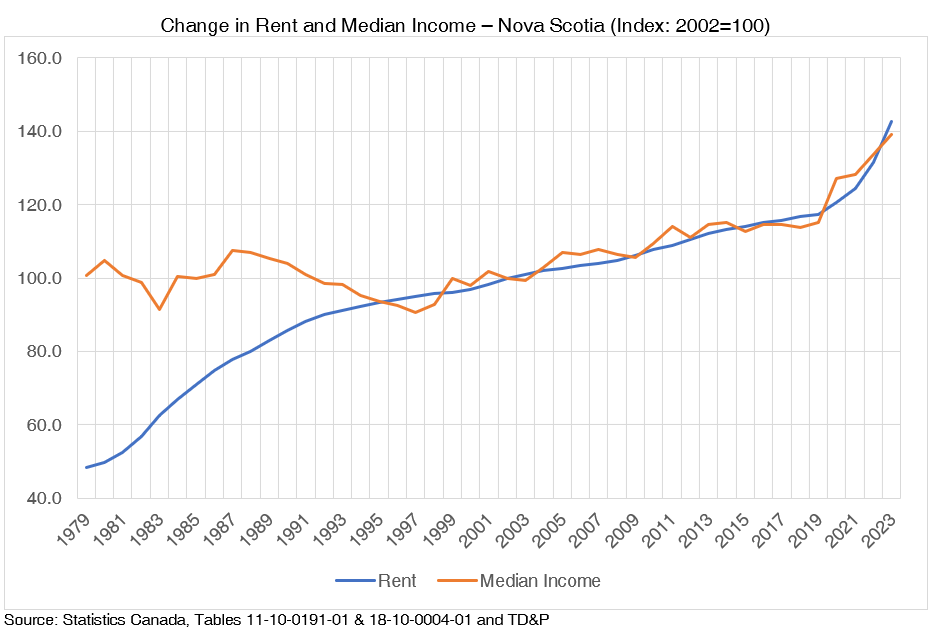

Statistics Canada divides shelter costs into rented accommodation and owned accommodation. The largest weighted component for rented accommodation is the rent index, which is basically the change in rent over a base year (2002). Actually, the rent index is the only component for which data is available for Nova Scotia.

Since 2002, rent index in Nova Scotia has grown by 42.8 points while median household income has grown by 39.0 points. You see the rent really increase after 2021. Almost 43% of the two-decade growth in rent transpired after 2020. But household median income has been able to keep pace, so far. The sharp jump in income you see in 2020 was because of all the income assistance we spoke about earlier. Just that one year, the median household income in Nova Scotia increased 10.3%.

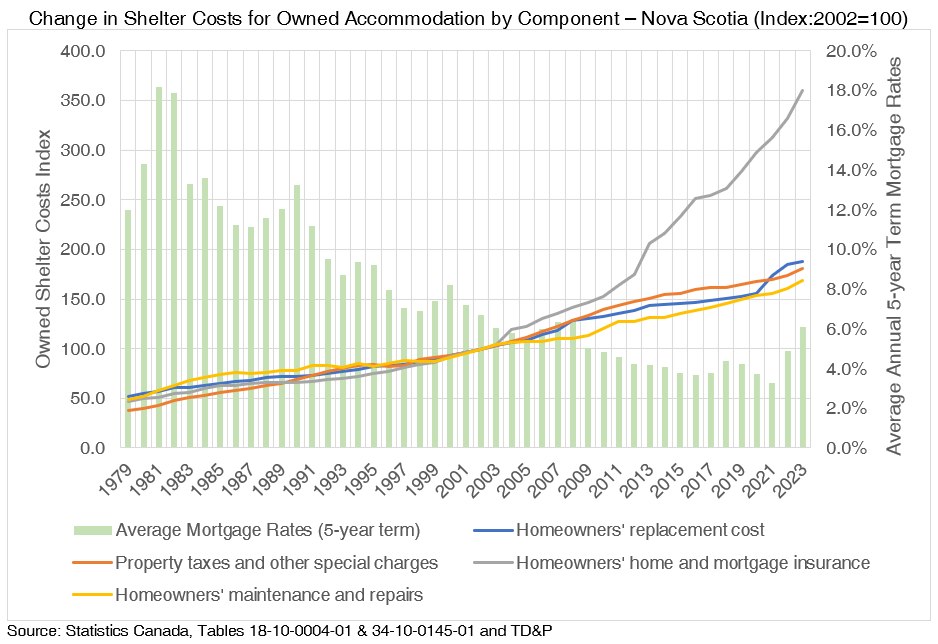

Now, moving on to owned accommodation, it does not include prices for the purchase of property. Instead, shelter costs for owned property includes components such as mortgage interest cost, homeowner’s replacement cost, property taxes and other special charges, home and mortgage insurance, maintenance and repairs, and other owned accommodation expenses. Unfortunately, data gets suppressed at the provincial level for mortgage and interest cost, but we can see how costs for the other components have changed over the years.

Among these components, the one that stands out the most is the cost for homeowners’ home and mortgage insurance, which has grown 21.2%, more than any other component since 2020 (property taxes and other special charges grew 8.1%, and home maintenance and repair costs grew 9.9% over the same period). We have seen home prices grow at record levels in Nova Scotia, and in Canada more generally. When the home prices increase, it means it would cost more to replace those homes, so the insurance price for those homes increase as well. The other half of this, mortgage insurance costs, is the cost of insuring your loan in case you default. It is available to homebuyers, through the Canda Mortgage and Housing Corporation, giving prospective home buyers the chance to put down less than 20% of the purchase price. It is an insurance to the lender in case the borrower defaults. It isn’t available if the home price is a million or more. If it’s any consolation, this dramatic growth didn’t just start after the pandemic. The first large increase in home and mortgage insurance costs in our province came in 2004 (+13.9%), then another in 2013 (+18.2%), and then the latest in 2023(+8.4%).

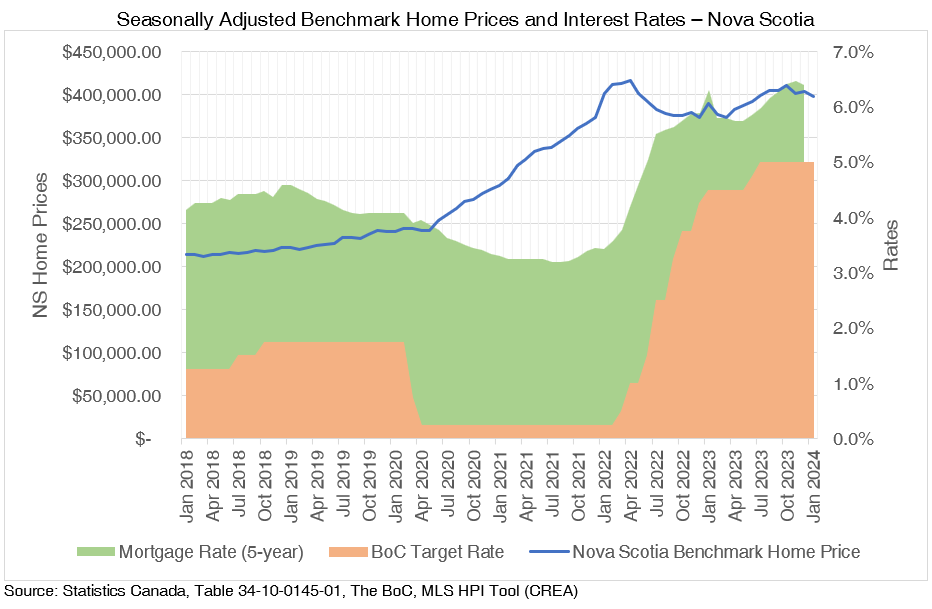

So, we see that despite inflation creeping into the BoC target threshold, shelter costs remain on the rise. But can we expect these to come back down? Well, one of the biggest things that this depends upon is the price for homes. If the price for homes were lower, home and mortgage insurance amounts would be lower too. There are signs that suggest that the periods for large home price increases are behind us for now. The benchmark home price in Nova Scotia in January 2024 was 1% lower than two years ago. In fact, since it peaked in April 2022, the benchmark has fallen 4.5%.

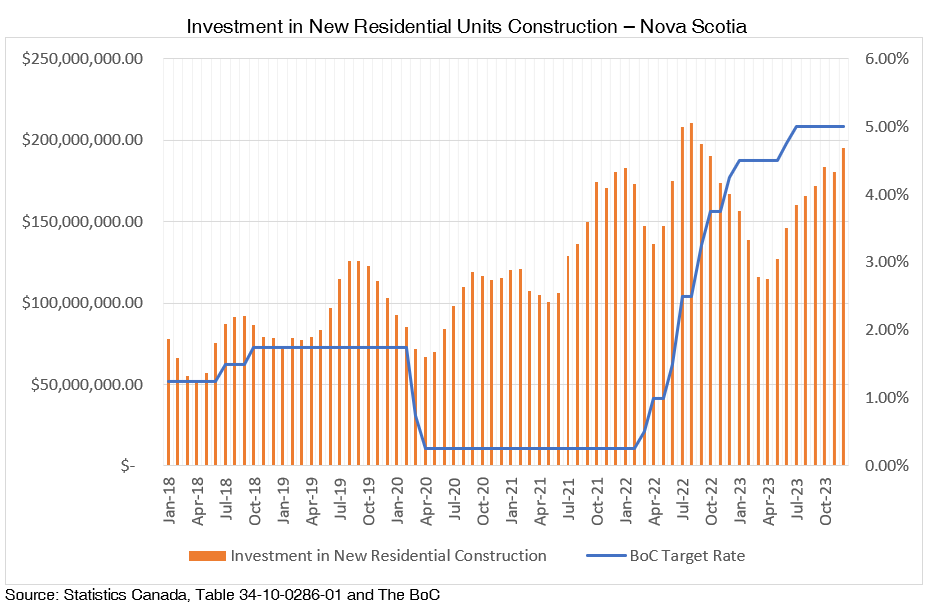

What can be done to ensure that home prices are kept in control going forward? As a classical economist, I will answer that it simply boils down to supply and demand. Yes, interest rates are high, but there must be continued investment in housing construction because the province is only going to grow in population, not to mention the already rampant issue of homelessness in the country. The good news is that that seems to be what is happening. Year-over-year, Nova Scotia’s investment in residential construction grew 16.9% in December 2023; it was up 69.3% since December 2020. In the 2024-2025 budget that Nova Scotia released last week, I counted close to $200 million being dedicated to “more housing, faster,” and the news, to me at least, couldn’t come faster.

I expect the BoC to lower their rates later this year as well. But we have to keep in mind that despite inflation trending downwards, certain essential expenses continue to soar, posing challenges to affordability and financial resilience for households. Yet, amidst these challenges, the concerted efforts to bolster residential construction signal a proactive stance toward addressing the root cause of housing affordability; the lack of it.

Jigme Choerab is manager of our Economic Intelligence Unit. For more information about how you can benefit from the unique expertise of our Planning & Economic Intelligence team, contact Jigme at (902) 429-1811 or .