2024 saw many shifts in Nova Scotia’s housing market. When the Bank of Canada (BoC) gradually lowered the interest rate, we saw it have a direct impact on home prices, apartment rents, housing starts, unit completions, and many other market indicators. Moreover, with the Housing Accelerator Fund’s (HAF) promotion of densification as a key driver to increase housing supply and improve affordability, the type of units being constructed may start to sway from historic trends in the near future.

Now that we are fully into 2025, here is a quick review of what happened in the Nova Scotia housing market in 2024, and what I think is on the horizon. Before we jump into it, however, let’s put the market in context.

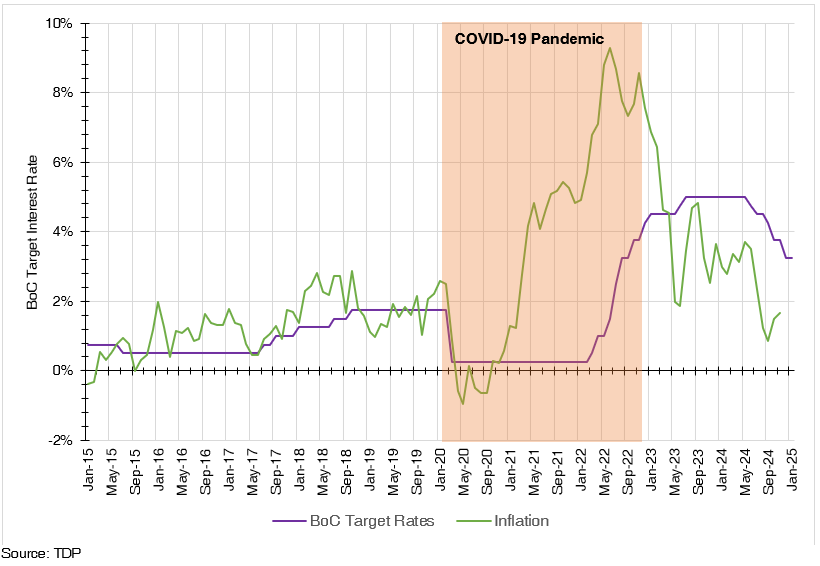

Figure 1. Interest Rate and Inflation in NS

In March 2020, the COVID-19 pandemic started and the world went into lockdown. At first, the low demand resulting for those lockdowns meant that prices fell broadly, and Nova Scotia actually experienced negative price growth (deflation) between April to September 2020. When prices started falling the BoC rapidly started dropping their target interest rates. In March 2020 alone, the BoC lowered their target from 1.75% to 0.25%. The idea was to encourage people to spend and businesses to invest, and it worked. It worked a little too well. There was so much money saved up during the pandemic and so much pent-up demand, that it spurred a period of rising inflation, the result of high demand and low supply for basically everything, starting from December 2020 when inflation was 0.58%, until June 2022 when it peaked at 9.29% (the highest in four decades).

With inflation running out of hand, the BoC decided to raise interest rates in March 2022 to 0.50%, up from the 0.25% it had remained at since the start of the pandemic. We then saw a series of rate-increases until May 2024, where the target rate reached 5.0%, the highest it had been since 2001. By mid-2024, inflation was coming down to manageable levels, but the economy was not doing too well, with low productivity levels and a growing unemployment making the news. To combat this, the BoC brought the target interest rate back down to 3.25% by December 2024.

I’ve stressed on the movement of interest rates over the last few years because I’ve never in my lifetime seen such rate maneuvers be used to manage a crisis. And it was a crisis. The three-year period from 2022 to 2024 saw not only a cost-of-living crisis, but also a housing crisis in most parts of Canada and the world. Also, we know that the target interest rate that the BoC directly determines the rates banks charge for their loans including mortgages, directly affecting home prices, housing, supply, and thus housing affordability.

- Housing Starts in NS

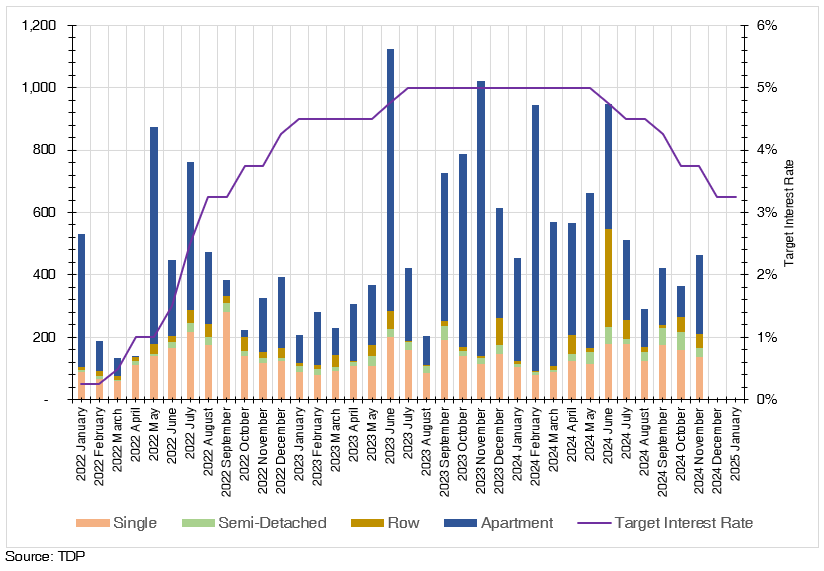

Figure 2. Starts by Unit Type, Monthly, Nova Scotia

In 2024, February and June were particularly strong months for unit starts in Nova Scotia. Of the 944 starts in February 854 (90.5%) were apartment units. In June 399 (42.2%) of the 947 starts were apartments, and 316 (33.4%) were rowhouses.

As of November 2024, 61.5% of year-to-date starts in Nova Scotia were apartments. Single-detached homes made up 23.7% (11 percentage points lower than its share in 2022).

Bottom line: 2024 (January to November) was the second-strongest year Nova Scotia has ever had in terms of housing starts at 6,200, behind only 2023 at 6,303. If it is found that the province added 104 more starts in December 2024 when the data is out (which is not unlikely at all given historic figures), we may be looking at the best year in terms of starts for the province. More housing starts now means more housing stock in the future.

- Completions in NS

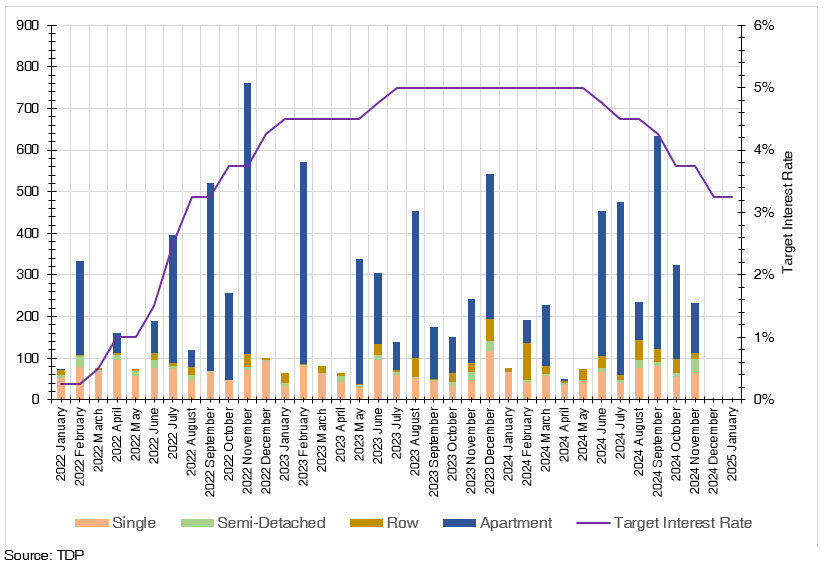

There were three months in 2024 where unit completions were less than 100 in Nova Scotia: January saw 77 completions; April saw 50 completions; and May had 75 completions. The month with the most unit completions was September at 633.

As of November, 2024 saw 2,975 completions, which is lower than the figures for both 2023 (3,131) and 2022 (3,061). In 2023, 1,917 apartments were completed, along with 636 single-detached homes, 322 rowhouses, and 100 semi-detached homes.

Bottom line: Annual totals for unit completions have been fairly stable between 2021 and 2024. High interest rates and cost of building construction have not led to a notable decline in completions, but the historically high number of starts have also not increased the number of completions.

Figure 3. Completions by Unit Type, Monthly, Nova Scotia

- Units Under Construction Per Month, NS

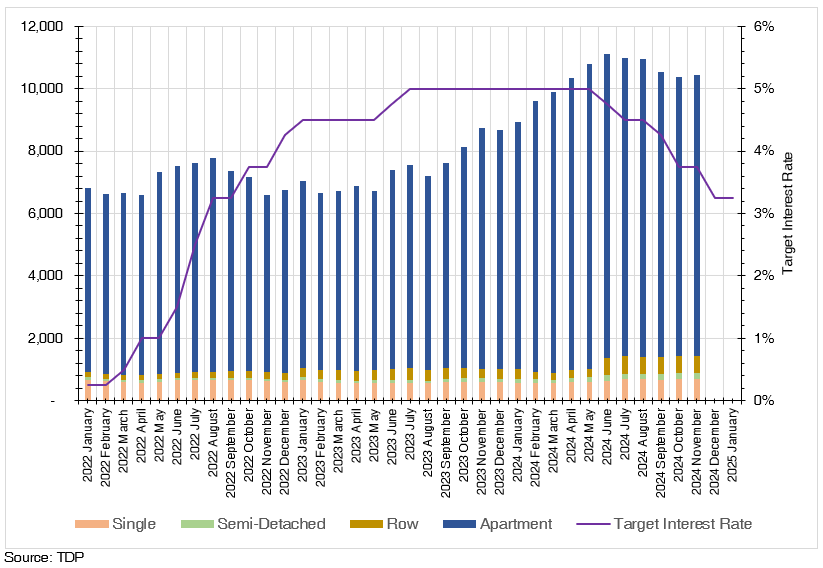

The number of units under construction reached new highs in 2024. There was on average 10,355 units under construction every month in 2024, about 2,900 units more than in 2023 when there were 7,444 units under construction every month. June 2024 saw 11,117 units under construction, by far the highest monthly number the province has ever seen.

Driving the high number of units under construction was the construction of apartments. 2024 saw an average of 9,142 apartment units under construction every month in 2024, compared to the monthly average of 642 for single-detached, 153 for semi-detached, and 418 for rowhouses.

The issue is that these record high number of units under construction may not be good news unless we see an increase in unit completions. 2023 and 2024 saw very high number of unit-starts in Nova Scotia so it is reasonable that we also see many units under construction. However, if the stable number of annual completions do not increase in 2025, it would be indicative of an environment that possesses low efficiency in translating starts to completions.

Bottom line: There are a lot of units under construction that need to be converted to completions.

Figure 4. Units Under Construction by Unit Type, Monthly, Nova Scotia

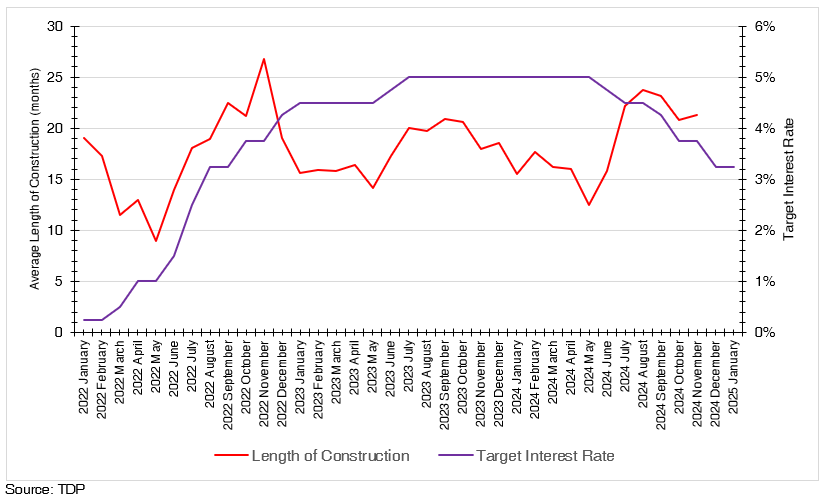

- Average Length of Construction by Month, NS

Information available on the average number of months taken for a unit to be completed from start to finish gives us some direction as we seek to answer the question laid out in the previous section.

On average, in November 2024, the average length of construction was 21 months. This encompasses every unit type. The longest it took for a unit to be completed was 24 months in August 2024. Another thing to note here, is that I calculated 3-month rolling averages to control for seasonal variations. Without such adjustments, the longest observed average length of construction was 29.7 months in June 2024. Though high, it remains lower than the alarming highs of 33 months observed in September 2022.

Looking at construction length by unit type, November 2024 saw apartments taking on average 22.5 months to complete. Both single- and semi-detached units took about seven to eight months, and rows took about 11 months.

Bottom line: The number of units under construction is high not only because there are more units being started, but also because it is taking longer to construct units in general.

Figure 5. Length of Construction in Months, Three-month Rolling Average, All Units, Nova Scotia

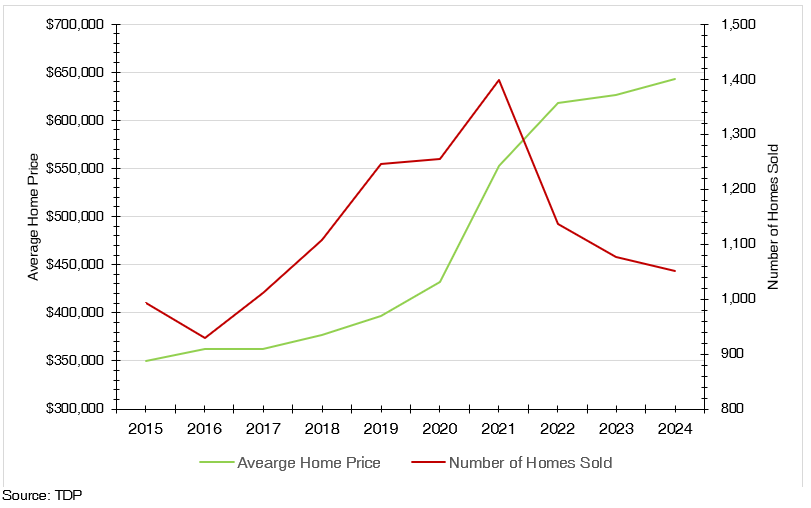

- Average Home Sale Price, Total Sales, Demand, HRM

Using HRM as a proxy for the province, we have analyzed average home prices vs number of homes sold.

Figure 6. Average Home Price and Number of Homes Sold, HRM

The average home price in HRM (which includes both new and resale homes) was $642,994 in 2024. The 2024 average represents a growth of 2.6% over the 2023 average of $626,800, and is 62.3% higher than the 2019 average of $396,282.

With such growth in average price, the number of homes sold has declined notably. There were 1,051 homes sold in HRM in 2024, down from 1,076 in 2023, and 1,137 in 2022. Home sales peaked in 2021 with a total of 1,399, which was also the time when interest rates were at 0.25%, and thus buying a home was relatively easy.

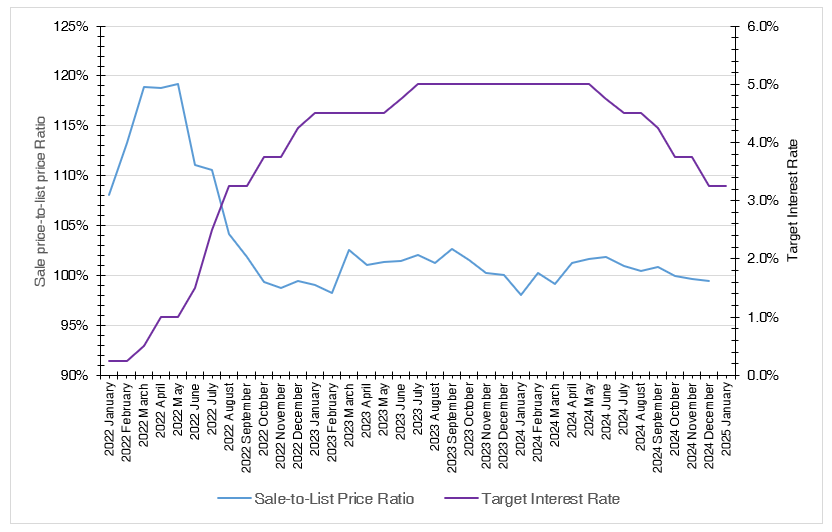

The sale-to-list price ratio is generally used to represent demand for housing because it represents how much a home is sold for compared to what its listing price was. The last two months of 2024 had average sale prices lower than the average listing prices. Overall, the 2024 average for the ratio was 100.5%, meaning that average home sale prices were 0.5% higher than what they were listed for, the lowest it has been since 2019.

Taking a more monthly look, figure 7 shows how the demand for homes dropped as soon as BoC’s target interest rate started its climb in April 2022.

Bottom line: Average home prices are still increasing, but the demand for homes has been, and is continuing to fall.

Figure 7. Average Sale-to-List price Ratio, HRM

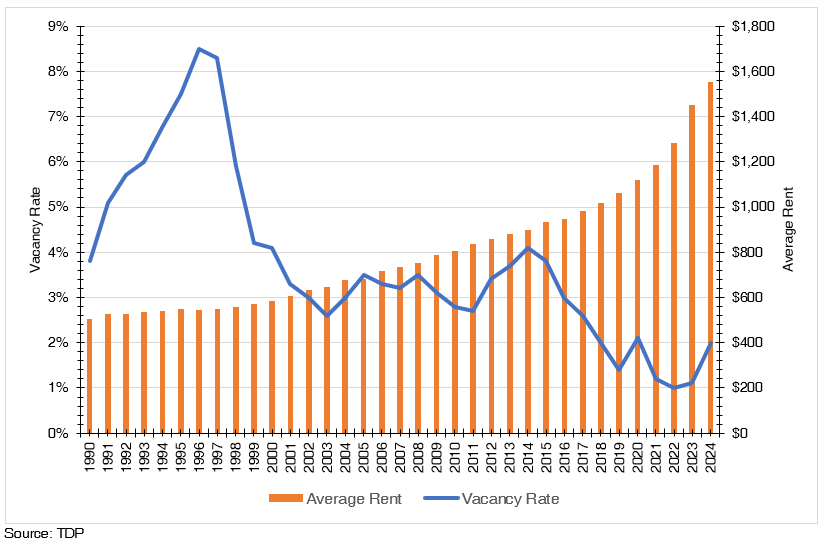

- Average Apartment Rents and Vacancy, NS

Average rents in Nova Scotia reached a new high in 2024 at $1,552. This is an average across rents for all unit types and bedroom counts. The 2024 figure is a 7.0% increase over the 2023 average of $1,451; and a 45.9% increase over the 2019 average of $1,016.

On a more positive note, the vacancy rate increased to 2.0% in 2024, from 1.1% in 2023. Although this is nowhere close to the highs of observed in the mid-90s, it is a relief for renters in the province who have been price-takers for the last few years with vacancy rates at or close to 1%.

Bottom line: Average rents continued to grow in 2024, although at a slower pace; and an increasing vacancy rate is welcome news for the rental market.

Figure 8. Average Rent and Vacancy Rate, Nova Scotia

As Nova Scotia’s housing market moves into 2025, the challenges of affordability, supply constraints, and economic pressures remain at the forefront. The past year’s policy shifts (HAF incentivizing multi-unit builds), interest rate fluctuations, and record-high construction activity laid the groundwork for potential stabilization, but the market’s trajectory will depend on how quickly new units are completed and how effectively supply bottlenecks (both in terms of labour and construction materials) are addressed.

Looking ahead, key dynamics to watch include the pace of housing completions, the impact of easing interest rates on demand, and the balance between densification strategies and broader affordability goals. With a large portion of the housing stock still under construction, 2025 presents an opportunity to reshape the province’s housing landscape—if stakeholders can align policy, productivity, and innovation to meet growing needs.

For a deeper dive into the findings and data analysis from our latest research on affordable housing in Halifax, reach out to Turner Drake & Partners for comprehensive reports and expert insights on regional housing trends and solutions.

Jigme Choerab is manager of our Economic Intelligence Unit. For more information about how you can benefit from the unique expertise of our Planning & Economic Intelligence team, contact Jigme at (902) 429-1811 or .