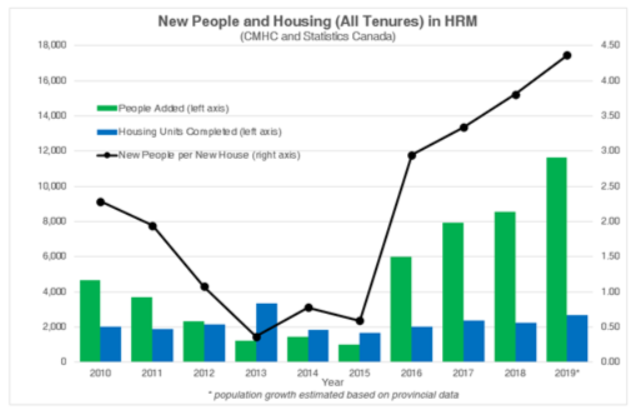

CMHC has just released its annual rental market survey data, and the results are concerning for the Halifax Regional Municipality. After 2018’s record low vacancy, we’ve been eagerly waiting to see whether supply or demand would win the race this past year as both construction and population growth continue their fevered pace. Unfortunately for renters, it looks like demand has again won. With new supply undershooting by 280 units over the year, the overall vacancy rate has now plummeted from 1.6% to a new record low of 1.0% in 2019.

While the challenge of finding an apartment is stressful enough, unfortunately for renters the bad news doesn’t stop there. Vacancy rates are a leading indicator for rental rates, and this year’s results show the first hard evidence that tight market conditions are translating into price increases within the existing rental stock. Once the competition for limited available units heats up, price increases kick in as the market begins rationing too little supply among too much demand. While the statistics of overall average or median rents have been on the rise for a number of years, this has largely been driven by the addition of new, more expensive buildings to the rental pool. Yearly increases in existing buildings were muted, proceeding at around 2% per year even in record-setting 2018. However, thanks to the knock-on effects of that year’s diminutive vacancy rate, same-building rents in 2019 show an increase of 3.8%. This is nearly double the historical average, and the largest single-year increase on record. The 2019 vacancy rate of 1.0% therefore does not bode well for renters in this year to come. Things are going to get worse before they have a chance to get better!

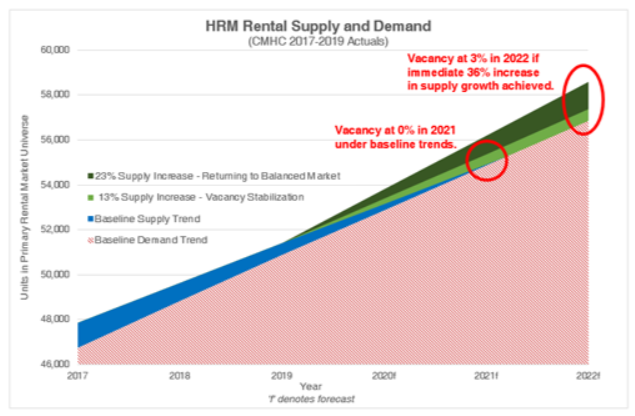

On that note, what is it going to take for things to get better? Despite record-levels of construction in the purpose-built rental sector, the market supply is not growing fast enough to meet demand (hence the reduction in vacancy). Based on average figures for the last 3 years, the period where population growth has driven vacancy below its typical range, the calculations are humbling. HRM would need to increase the supply growth rate by about 13%, delivering an extra 230 units per year, just to stabilise the vacancy rate and keep up with the growth in demand. Of course, holding vacancy at 1% won’t help with prices. In order to return the market to a reasonable 3% vacancy rate, there would have to be a further increase of 23%, another 410 units per year, and this would have to be sustained for the next 3 years in order to get back to balanced market territory.

Multiunit starts were up in 2019, but only by 15%. This is an industry already at record activity levels and it strains to push the pace further. Additionally, provincial level data is suggesting HRM’s population growth may still be accelerating. As a result, odds are that a sufficient increase in the growth of rental supply is not about to materialise in the short term to provide relief.

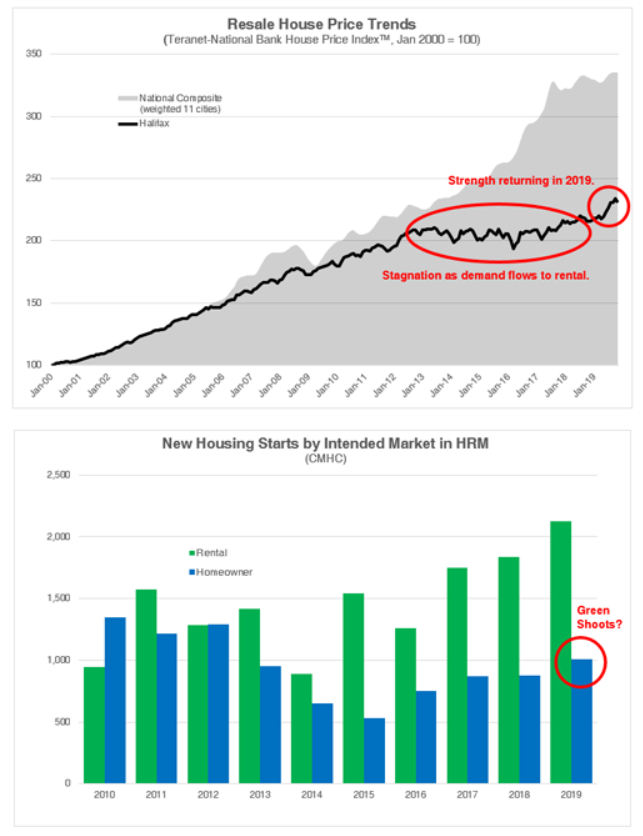

So what solace can we offer? Well, it’s not much to take to the bank, but we may be seeing the start of demand-side trends that could help blow off some pressure. Much of the population growth pressure is driven by new people arriving in the city from elsewhere in the province, county, and world. Having a few years under their belt now, not-quite-so-recent migrants and non-permanent residents could start to flow out of the rental sector. Having found their feet, these groups may look to transition into the homeownership market as they seek to become more established (or, in the case of international students, simply move away as their studies conclude). Of course, there are also domestic trends to consider as well, and while rental demand growth from downsizing boomers is unlikely to relent, an increasing number of millennials are aging into their prime home buying years.

Often lost in the rental housing conversation is the fact that despite the frenzy of apartment construction, HRM has actually not built very much housing in the last few years overall. Unlike other Canadian cities where a surge of rental construction has come only after owner-occupied markets launched out of financial reach, HRM’s rental supply is the first preference for many. This means rental housing has been voraciously consumed at the same time that homebuilders have struggled to find demand for their available lots. As a result, the explosion of apartment construction has been largely offset by a drop in subdivision development.

Perhaps things are turning around, however. This past year may have heralded disappointment for renters, but it provided encouragement for owners; price action in the resale market showed strength that we haven’t seen since the early 2010s, and with it came an uptick in new construction activity as well. Is this evidence that some of HRM’s recent population growth is starting to flow from the rental sector into ownership?

This would certainly be good news for the homebuilding industry, which has been a shadow of itself for several years. It would also be good news for those still in the rental market, as a revived owner-occupied market would ease pressure on rentals by siphoning off some of the housing demand. Further, reactivating the idle resources in the homebuilding sector is an easier means of increasing the growth rate in total housing supply than hoping for the multiunit sector to conjure up a significant escalation in their maxed out production levels.

Turner Drake is engaged in Housing Needs Analyses from coast to coast. To see how your community can benefit from the unique expertise of our Planning and Economic Intelligence team, call Vice President Neil Lovitt at (902) 429-1811 or .