I recently read an article by the CBC entitled “From sacred to secular: Canada set to lose 9,000 churches, warns national heritage group.” The article discusses shrinking congregations as member’s age, move away or switch to new spiritual practices. The article notes that in Eastern New Brunswick alone the Roman Catholic Archdiocese for example predicts that 20 of its 53 parishes will likely close if the congregations can’t find a way to generate more money. With less money coming in and higher maintenance and operating costs churches face a challenging future.

This article resonated with me on a professional level and personally as a member of a local church. In the past few years our firm has been contacted by a number of churches, in particular church committees made up of congregation members. These committees are assigned the unenvious task of exploring what to do with their beloved church as it faces the challenges of a shrinking congregation.

The common questions asked by committee members to aid in their decision making include:

Scenario #1: What is the value of the church as it currently operates?

Scenario #2: What is the value of the underlying land as a redevelopment?

Scenario #3: What if the church were sold for an adaptive re-use, what would it be worth?

Essentially the committees want to determine the Highest and Best Use of their property, with values determined for each scenario so they can be make an informed decision, and ultimately present it to their congregation.

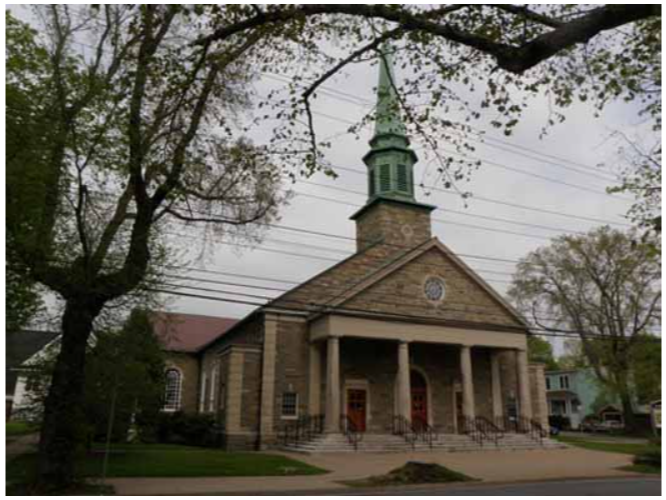

Churches serve a number of roles for their community. Outside of Sunday church services and funerals they are used as polling stations, a place of refuge after disasters, a place for private and not-for-profit groups to meet, a venue for concerts, fundraiser dinners and suppers and a place for performing arts to operate out of. While church layout and design elements vary between denominations the fundamental church layout is fairly consistent. Typically it includes a large entrance lobby, a sanctuary, parlour, large multi-use hall together with a kitchen and a number of smaller rooms used for meetings and general storage. They tend to have several large, wide-open areas with high ceilings together with a large number of smaller classrooms. As a result of their special purpose design they are challenging to value.

Scenario #1 – determining the Market Value of a church as it currently operates may not be as hard as it sounds. There are numerous examples of church properties that have sold to other congregations for continued use as a church.

Scenario #2 – determining the value of the underlying land for redevelopment is more challenging. Often times the property has an institutional zone assigned to it, reflecting its current use. However, this doesn’t necessarily limit the property to its current use. It can often be re-zoned and redeveloped for a more intensive use. Exploring this scenario involves discussions with the local planning authority, and in the end professional judgement is needed. In addition to re-zoning, heritage designation issues, service and utility easements on the parcel and demolition costs for the existing building must be explored and considered under this scenario.

Scenario #3 considers the value of the church for an adaptive re-use. This can certainly be the most challenging scenario to consider when determining value. The question here is “does the existing building actually provide additional, measurable value?” Older buildings often have a lot of character and heritage value. However, the cost for repairs and maintenance for these older buildings can be substantial. They typically have masonry exterior walls with decorative features that require a lot of maintenance. Their walls are often load bearing, meaning they cannot be easily reconfigured for another type of use without substantial structural work. In addition they typically sit on expensive land, located in more central downtown locations with increasing pressure on land values. All of these things can point to demolition of the existing church to make way for a new development. However, that’s not always the case.

Recently I completed an assignment for a registered heritage property in Halifax. The Centre Plan envisioned a low-density residential use for the property. However, Package A contained significant implications for the property as it contains policy applicable to registered heritage properties. This general policy allows for consideration of new development via discretionary approval processes (a “Development Agreement”) rather than zoning. The overarching goal of the municipality is to encourage the rehabilitation and retention of heritage buildings. In order to do this, they will support a significant amount of new development intensity on sites containing a heritage building, using this as a tool to create sufficient value that the required conservation measures can be accommodated within an economically feasible project. This opens the possibility for significant building height and floor area ratios, as well as consideration of other cost-savings, such as lower parking requirements.

In that instance, the cost involved with demolishing the existing building coupled with only low-density anticipated for the site meant that demolition of the building was not the best option. Alternatively, retaining the existing structure, or a substantial portion of it under policy contained within Package A of the Centre Plan opened up the possibility for significant building height and floor area ratios, as well as consideration of other cost-savings, such as lower parking requirements. This second option meant a higher value for the property. In that instance the best option was retaining the existing building for an adaptive re-use as part of a larger development.

The take-away here is that valuing churches or special purpose properties is not a straightforward exercise. With shrinking congregations and higher operating costs these types of assignments are becoming increasingly more common. They can be complicated and require a team approach to valuing the property with assistance from planners with a solid understanding of the Centre Plan.

Nigel Turner, Vice President of our Valuation Division, can be reached at